It looks like we have a new winner in the “most insane number of new cities/routes announced in a day” category. On Tuesday, Frontier rolled out 85 new routes and 21 new cities in what has to be one of the biggest network changes in years. By next summer, Frontier will fly nearly double the number of routes nonstop compared to what it flies today. You might think there’s some clear strategy behind these moves, but so far I count three… or maybe four. I’m not quite sure what’s going on, but that won’t stop me from trying to make sense of this.

Let’s start with what should be an easy question but isn’t. How much of this is growth and how much replaces existing flying? Well, according to Airbus, Frontier still has 73 aircraft on order (2 A321s, 18 A319neos, and 53 A320neos), and some of those will start flying these new routes. But there are also some cuts that are funding this. For example, Denver to Atlanta gets cut from twice daily to once. Denver to LA goes to 11 times a week instead of twice daily. There are a bunch of those, but there’s also a lot of noise. Frontier runs a very seasonal schedule, so there are the usual route suspensions and additions that come around every time there’s a seasonal change as well. Suffice it to say that this isn’t all growth that’s being announced, but a huge chunk of it is.

When an airline makes a move like this, it’s usually done to feed a strategy. Spirit used to focus on flying between big cities with low frequencies. Allegiant did small city to big destination markets. That kind of thing. But in this one, I’m just grasping at straws. There do seem to be three overarching themes where the bulk of these moves fall.

- Rebuilding a Denver Hub

- Florida on Steroids

- Secondary Airports Thrive

There’s questionably a fourth, and then the rest just seem like random fill-in. Let’s break those down.

Rebuilding a Denver Hub

In the beginning, Frontier was all about Denver and Denver alone. The Mile High City was the airline’s hub, and it was competing ferociously with United. Things changed quickly, however. Southwest invaded Denver, Republic bought Frontier and merged it with Midwest, Frontier moved toward an ultra low cost carrier model, and then it was sold off. Denver’s importance has shrunk at every stop. Over time, Frontier found itself serving fewer cities from Denver with less frequency on those routes that remained. Southwest quickly made a big dent in the local market while United turned its hub into the most profitable in its system.

But now, Frontier is back, baby. And it’s adding a ton of new cities. Take a look, thanks to the Great Circle Mapper.

With the exception of Albuquerque, Oklahoma City, Ontario, and San Jose (which fly once daily), all of these new routes will be flown 3 or 4 times a week. So we aren’t talking about Frontier rebuilding a major hub with multiple banks. But we are talking about Frontier creating connecting opportunities on the days that these fly. Some of that is intentional. Take a look at this quote from CEO Barry Biffle.

“Customers will benefit not only from the broad new selection of nonstop routes, but our growing network will provide more than 1,000 new connecting route options,” Biffle continued. “By taking advantage of our natural share of connecting passengers, we can offer our low fares to even more of America. This is particularly important through our largest hub and our home in Denver.”

First, I have to point out the mention of “natural share.” United President Scott Kirby has been spouting off about the airline’s need to regain its own “natural share” lately. This is very clearly a well-placed dig at United. But that’s fluff. What’s the real strategy here?

Certainly Frontier would like to get local traffic, but that’ll be tougher with a stronger United and Southwest in the market. Still, some infrequent markets like Charleston or Buffalo could do well.

But there is an acknowledgment in that quote of the value of connecting traffic. That’s weird since ultra low cost carriers aren’t usually too interested in anything but point-to-point. After all, connecting traffic usually produces less revenue, costs more, and adds a bunch of complexity.

Since many of these new Denver markets have yet to go on sale, I can’t quite figure out the extent of the connecting options. But I had to at least poke around and find some pricing examples to see how Frontier viewed this traffic from a pricing standpoint.

After several tries in markets where no connections existed, I found something in Ontario to Oklahoma City. Granted, it’s an overnight connection, but on November 14, Frontier wants $295 for you to connect overnight via Denver. Ontario to Denver alone on the 14th is running $49. Meanwhile, Denver-Oklahoma City on the 15th is priced at $219.

Then I looked at LA to Albuquerque. That’s running $109. But from LA to Denver, the airline won’t even sell you a ticket unless you join the Discount Den paid membership club. Then it’s $39. And Denver to Albuquerque is $39 for anyone.

So Frontier is offering connections, but it’s charging more for the privilege. On a side note, it’s also pursuing a really obnoxious strategy where you can’t even buy a ticket on that one route (at least on November 14) unless you buy a club membership. Careful, Frontier. People hate that.

So there you go. Frontier is selling connections, but it’s not discounting the point-to-point pricing, at least in this small sample. It’s weird, because you can fly Ontario to Oklahoma City on United for only $165.80. And you can fly nonstop from LA to Albuquerque for $65.20. So Frontier may be talking up connections, but they aren’t going to be very useful unless this strategy changes. Of course, if it changes, then the revenue might not be worth it.

Florida on Steroids

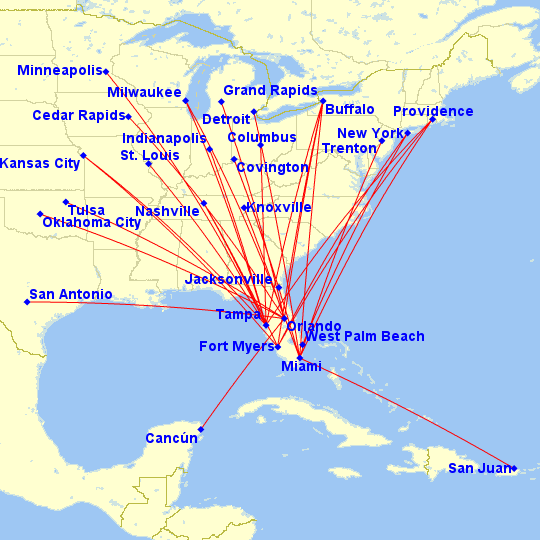

There’s not much more terrifying than the idea of Florida on steroids, but fortunately I’m not being literal here. What is happening is that Frontier is adding a slew of new routes from airports all across Florida. Take a look. Again, thanks Great Circle Mapper.

The labeling is a little goofy here, but Covington = Cincinnati and New York = Islip. As you can see, Frontier is attacking the state from all angles… except from Ft Lauderdale. Instead, it’s building up Miami with new flights to Buffalo, Cincinnati, Detroit, Milwaukee, Providence, San Juan, and Trenton. Frontier had dipped its toes into Miami awhile ago, but no other low cost carrier had been willing to stomach Miami’s high fees. Apparently it’s working well enough for Frontier that it sees an opportunity for growth. That may well be the case as JetBlue, Southwest, and Spirit all brawl up at Ft Lauderdale. I personally still can’t get past the high fees.

Secondary Airports Thrive

For awhile there, it looked like Frontier was going to pull back from the secondary airports like Trenton which had been trendy at one point in the airline’s past. But those airports seem to have come back with a vengeance. Here’s the final Great Circle Mapper image.

This just focuses on Providence, Islip, and Trenton, but the airline has also launched three routes from Ontario outside of Los Angeles that fit the bill here too. I was not expecting to see such a resurgence in these kinds of markets.

This isn’t even everything. There is a fair bit of growth in mid-size cities like Austin, San Antonio, Raleigh/Durham, and Kansas City too. These are all the domain of Southwest, and I can’t imagine that airline is happy to see any of this. I almost called that a fourth theme, but I left it off.

And of course, there are seemingly random one-offs, like Atlanta to San Juan or Salt Lake City to Vegas. If I had to pick one word to describe this massive change, it’s… confusing. It seems like Frontier is throwing several different strategies at the wall plus some one-off markets for good measure.

Maybe this is the airline’s version of reality television. Throw a few different options out there and let the public decide with their wallets which one survives. Or maybe Frontier just likes this sort of chaos. I still can’t quite figure it out.

38 comments on “At Least Three Trends and a Lot of Noise in Frontier’s Massive New Route Announcement”

Thank you for this. I was really looking forward to your analysis of this, even if I still can’t quite figure out what Frontier is trying to do or what message it’s trying to send to customers.

I’d like to just point out one point of correction however — Frontier switched to the ULCC model only after Republic sold it to Indigo, the same group that flipped Spirit into a ULCC. For the time that Republic owned Frontier, it was a warmed over LCC mostly appealing to Denver business and leisure markets along with some confusing RJ operations. Frontier didn’t really turn into the ULCC dart-at-a-map beast (no pun intended) that it is today until only about three years ago.

Oh, and let’s also not forget that Frontier originally turned down a buyout offer from Southwest around 2008-ish while they were in bankruptcy. They went with Republic a little bit later instead. What a huge mistake that was in hindsight!

Charles – Frontier switched to the ULCC model before the sale to Republic. I first wrote about the switch to a ULCC at the beginning of 2012:

http://crankyflier.com/2012/01/30/frontier-charts-its-course-as-an-ultra-low-cost-carrier/

Then the company wasn’t sold until October 2013:

http://crankyflier.com/2013/10/03/frontier-is-finally-sold-if-the-unions-say-ok/

Fair enough! Thanks for pointing that out. I guess in my head, while they may have decided on becoming a ULCC under Republic, the transition didn’t become fully complete until later. Flying them in 2012 and 2013, I remember it still not feeling all too different from what Frontier was before. The writing was on the wall for quite a while that Republic was looking for a way to get rid of Frontier and vice versa.

Still amazing to think they didn’t take the Southwest buyout when they had the chance.

Maybe you could do an across the aisle to sort this out with your former colleague and my old boss.

http://m.marketwired.com/press-release/frontier-airlines-names-josh-flyr-vice-president-network-and-revenue-2200185.htm

very good analysis.

Frontier is looking for credibility in major markets instead of simply flying 3rd tier airports to Florida. Regaining its presence in Denver even if with relatively low frequencies is a slam at United and Southwest which have seen fares increase dramatically as Frontier has cut its footprint over the past several years. Miami can work; Frontier just has to include the high fees into its fares. Dancing around NYC is as good as the ULCCs are going to be able to do – but there are obviously millions of potential passengers to target .

It is likely that a number of these routes won’t work but Frontier threw down the gauntlet and so far, United responded strongly that it would aggressively compete which highlights that UA has a lot to lose and Frontier will play up its ability to create value for consumers even in the face of aggressive competition.

One correction for the Florida map – CLE gets new service to MIA.

Speaking of Frontier oddities, that gives them 18 nonstop destinations from CLE, more than any other carrier. Frequency, of course, is a different story.

Another piece of the puzzle, PVD has received 8 new routes in the past two Frontier announcements: DEN, MCO and CVG starting in August and MSY, MIA, RSW, TPA, CLT and RDU. In Providence it seems Frontier is also trying to compete in markets which the legacy carriers don’t have a cost base to make work (DL flew CVG & RDU for years with RJs, RSW and TPA are flown seasonally by WN in winter usually Saturday only). I wish Frontier all the best and can’t wait to see how WN who has gotten used to being the largest airline by far deals with ULCC intrusion on its bread and butter routes to Florida.

It will be interesting to see how the Calgary flights work out. Perhaps this could be the litmus test for how ULCC can work cross-border. Canada has not exactly been front and centre for F9, G4 or NK, but perhaps this may be the start

James – Shoot, I meant to call that out in my post and forgot! But yes, this is the first LCC effort to go into Canada that I can remember. The taxes and airport fees are generally very high, so it hasn’t been at the top of anyone’s list. It is really interesting to see this.

I haven’t flown Frontier since they operated 737’s so it’s been a while. That being said, the DEN hub worked well for east-west connections back in the day. As mentioned UA makes use of that airport for a very profitable hub and would think Frontier could do the same if they were efficient. Seems complicated if you have to join clubs, etc. and with WN in the market the dynamics may have changed a bit. Don’t think all those new routes can survive on O/D in the Denver market but best of luck to them.

I hope anybody making a connection through DEN has a contingency plan if they misconnect there (weather, mechanical, etc. delay). Without proper planning, the next flight on Frontier may be days away.

Cranky’s concierge !…

IPO is the answer.

They tired to go public Q2/2017, but it didn’t happen, I guess the price/interest weren’t high enough.

Indigo is trying to exit their holdings and with SAVE’s soft prices, frontier won’t get top $.

This is purely a strategy to get the company public at a good price.

I agree — with a twist. I believe that this announcement of greatly expanded operations, plus the announcement of the IPO, are intended to scare one or more competitors into acquiring Frontier. Indigo wants out, one way or another.

Combining with SAVE is the only other option. I don’t think SAVE needs the headache mergering operations, when they are still growing 10-15% a year.

Ted – Apparently it was a bad strategy:

https://www.bloomberg.com/news/articles/2017-07-19/frontier-airlines-is-said-to-stall-ipo-until-at-least-september

United had some very strong fighting/insulting words to say on the subject of Frontier’s new strategy and their IPO, too.

They tried this at Dulles a few years ago and don’t have much service left. I would curious to see how many flights in this expansion are left in the next year. Kudos for Frontier adding Buffalo though, Southwest tried and failed the Denver market so hopefully Frontier will make it work.

Nice recap of the announcement Mr. Cranky! While all of this is interesting, F9 doesn’t have the gates (DIA) pilots or flight attendants to make it work. The main strategy at Frontier (Indigo) is to go public and merge with Spirit. Was interesting to note that F9 purchased a new headquarters building the other day, guess Spiritier will be based at DIA.

When Frontier II started they were a good airline. Bankruptcy and Republic ownership made this airline without leadership. Indigo’s ownership plan seems to be a copycat of Spirit and frankly Spirit does a better job. Frontier is still without a viable plan.

Sent from my T-Mobile 4G LTE Device

This announcement does one thing, it gets them a lot of publicity. They will have a lot of people checking them out since the cities involved cover everywhere in the US.

If they had just announced a few routes at a time the public wouldn’t notice, this way they do and the airline can capitalize on the publicity.

One thing is obvious about Frontier over the past 8-10 years: all this new alignment will change, and probably sooner rather than later.

Cranky, what’s your opinion on some of Scott Kirby’s fighting words regarding DEN on UA’s earnings call? Hot air or a valid criticism?

Itami – Hard to know. It’s certainly overblown on purpose, because that only helps United. But it’s not really clear if this is a mistake or not. We don’t even have more than half the new markets from Denver on sale yet.

IT’S WAR: United Airlines president slams Frontier after $39 ticket announcement and vows ‘United will win’

https://www.msn.com/en-us/money/companies/its-war-united-airlines-president-slams-frontier-after-dollar39-ticket-announcement-and-vows-united-will-win/ar-AAosDt7

UAL’s stock has been clobbered over the last two days; their weak 3rd quarter guidance wasn’t helped by Frontier’s announcement -and UAL’s response.

Other carriers are in the crosshairs of Frontier’s expansion whether it works or not. UAL was the only one that commented and their stock went down the most.

Hasn’t this sort of thing gotten antitrust attention before? I recall NW had tendencies towards a scorched-earth approach when LCCs attempted to enter their monopoly markets?

For a current example of Frontier’s rapid market entry and exit, see COS this summer with big fanfare of entry into COS-SFO, COS-ORD, COS-IAD – all gone by this fall. It would take a lot of work, but might be interesting to see how many markets they have abandoned in the past 3 years. They have not stayed with one philosophy for very long. Their melt-downs at DEN in bad weather with low frequency options for recovery do not bode well for returning to a heavy focus on a DEN hub and is mystifying in view of their apparent success with the point-to-point approach. With the purchase of a new headquarters building, is a Spirit merger truly a more likely future for them?

Allot of those DEN adds are UAX or UAX-heavy markets. Kind of puts a squeeze on UAXs substandard product, cost and staffing problems.

It’s no coincidence that most of those DEN adds are UAX or UAX heavy markets. Puts a squeeze on the substandard product and UAX cost and staffing problems.

It depends on what plane UAX uses. If it is an E70/E75, then UAX actually has the better product. You get the same seat width, no middle seat, and more legroom.

I also saw that they are adding SJC-LAS, AUS, and SAT. LAS already has a legacy (DL) flying an E75 and WN. AUS will have AS flying an E75 and WN already flies this route. I think SAT has no competition, but I don’t know how much or a market there is for that.

I guess F9 only competes on price. The E75 is a better product than any mainline plane IMO and WN has better legroom than F9. Plus, F9 charges you to for the privilege of carrying your own carry-on bag on the plane. DL doesn’t even do that with a Basic Economy fare. I’m curious to see how long their second entry into SJC will last.

I think you nailed it when you wrote, ” Throw a few different options out there and let the public decide with their wallets which one survives.”

Crankster: How about a new award for stupidest airline move of the Millennium. Call it the Midway Airlines Memorial Cup.

This thing smells so much like Midway it’s surreal. Midway was a nice little carrier flying DC-9-30s from Midway Airport to business destinations around the Midwest. Nobody cared enough to even challenge them when they were flying short-hauls a few times a day from a then nearly abandoned airport.

All was fine with this South Side Airline until it decided to attack United, American, Delta, and others head-on by winning a bidding war for the Eastern Airlines hub at Philadelphia. Suddenly, Midway was a threat to the well-being of the Eagle and the Tulip in Chicago.

Midway got squashed like a cockroach crashing an upscale picnic. Never knew what hit it until the aircraft brokers began picking over the DC-9s.

How Frontier is going to avoid being squashed by United is anyone’s guess. It’s not nice to fool with Mother Oscar, especially at Mother Oscar’s most profitable hub.

SPLAT!!!!

Couple of things to point out:

1. It’s virtually certain a wide swath of October/November additions will be seasonally discontinued in early April before all those not-yet-for-sale spring additions start. If for no other reason this must be true because it’s necessary to fund all that new flying starting in April.

2. Although we don’t have the spring schedule yet, i’m skeptical that there will be connecting banks. Frontier is not shy about selling 10-hour connections. Potential connections will certainly increase as they add so many more spokes to Denver, but many potential city pairs won’t have service or will require an excessive connecting time one or both directions.

3. Frontier did kind of fumble with their pricing. They sometimes roll out fares for Discount Den members first when they extend a schedule (as a perk of being a member) so they have access to the lowest fare buckets before non-members do. It may have been that brand new routes were populated with both Discount Den and regular fares and everything else loaded with this schedule extension only had Discount Den available at first. (I feel like it wasn’t cleanly consistent that way but I could be wrong.) But the problem is you generated HUGE PR buzz quite successfully yesterday and turned people away. For example Milwaukee-Fort Myers is a seasonal route coming back with the November schedule (and being increased from 4x/week to daily) but you still can’t buy it if you’re not in DD and it doesn’t even show up at all in places like Kayak and Orbitz.

Frontier was very successful at generating huge buzz with this announcement of a bazillion new routes and boasts of over 1000 city pairs (including connections). But I think they dropped the ball with the DD-only pricing. If they still want to use the DD-only at first it should have been plastered all over their PR blitz.

I understand DEN is their HQ but why are they trying to ramp up a hub in a market that has two established hubs? They’re already enjoying good success in CLE and CVG because UA and DL respectively have shown they aren’t going to aggressively defend those markets anymore. Just choose something like CLE, CVG, BNA or STL instead if you really feel you need one. Create a hub that’ll be easier to defend and focus on making money point to point like all self-respecting ULCCs.

I feel bad for the crew scheduling department at F9

El Paso (ELP) was one the 21 new cities announced in the route blitz but I still have yet to see any kind of schedule and fares except that the service wil not start until sometime next March and will operate on the ELP-DEN 4x weekly. This wil be Frontier’s second try at the ELP-DEN market if you count the original Frontier Airlines (FL) service they had for many years out of there. It would not surprise me if this service never gets off the ground or only lasts for a short time especially if the advance bookings before the start of the service do not come up to expectations.